Tokenomics

Velodrome Finance uses two tokens to manage its utility and governance:

$VELO— ERC-20 utility token of the protocol$veVELO— ERC-721 governance token in the form of an NFT (non-fungible token)

$VELO is used for rewarding liquidity providers through emissions.

$veVELO is used for governance. Any $VELO holder can vote-escrow their tokens and

receive a $veVELO (also known as veNFT) in exchange. Additional tokens can be

added to the $veVELO NFT at any time.

The lock period (also known as vote-escrowed period, hence the ve prefix) can be up to 4 years, following the linear relationship shown below:

- 100

$VELOlocked for 4 years will become 100$veVELO - 100

$VELOlocked for 1 year will become 25$veVELO

The longer the vesting time, the higher the voting power (voting weight) and

rewards the $veVELO holder receives.

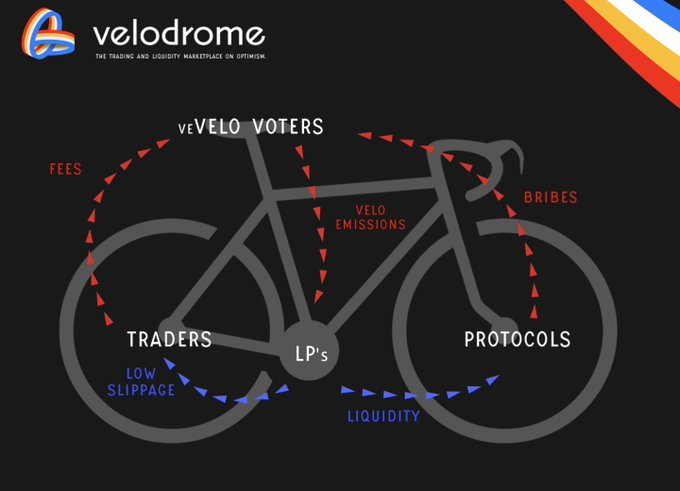

ve(3,3) Mechanics

Velodrome Finance mechanics reflect a combination of two DeFi concepts:

- Vote-Escrow — first introduced by Curve to strengthen incentives for long-term token holders

- Staking/Rebasing/Bonding or (3,3) game theory — designed by Olympus DAO

Combined, the ve(3,3) mechanism rewards behaviors correlated with Velodrome's success, such as

liquidity provision and long-term token holding. Liquidity providers receive $VELO emissions,

and $veVELO holders receive protocol fees, bribes, rebases, and governance power.

Below, we will walk through the components of the mechanism in order to explain how it helps the incentives flow to the most valuable of the ecosystem liquidity pools.

Initial Distribution

The airdrop claim period is now complete. Thank you to everyone who participated!

At launch we distributed $VELO and $veVELO to

users and protocols we believe are likeliest to contribute to our

mission to become the liquidity base layer of the Optimism ecosystem.

Distribution

Community

240M (60%) $VELO tokens will be distributed to the people who have played the biggest role in

incubating Velodrome and those likeliest to contribute to its long-term

success, including:

$WEVEholders (27%, 108M$VELO)$OPnetwork users (18%, 72M$VELO)- 3755

$VELO/wallet — Addresses qualified as Repeat Optimism Users

- 3755

- Cross-chain DeFi users (15%, 60M

$VELO):- 3500

$VELO/wallet — Curve Protocol wallets with a 1450+ days (maximum)$veCRVlock time - 3000

$VELO/wallet — Convex Protocol lockers of$vlCVXsince new lock contract deployment - 3000

$VELO/wallet — Treasure DAO Genesis Mine$MAGICstakers for 1- and 3-month periods - 2000

$VELO/wallet — Platypus Protocol stakers with$vePTPand$PTPbalance - 500

$VELO/wallet — Redacted Cartel participants in genesis Dutch auction who didn't sell their$BTRFLY - 500

$VELO/wallet — Eminence Finance wallets affected with EMN, eAAVE, eLINK, eYFI, eSNX or eCRV balance

- 3500

Protocols

We will consider a variety of metrics in assessing the available protocols, including TVL, transaction volume, unique wallets, and Optimism team input.

The airdrop of 72M (18%) $veVELO is aimed at attracting and engaging 10-15 protocols most

likely to contribute to Velodrome and Optimism's long-term success.

The amount of $veVELO airdropped will provide just enough voting power to familiarize

the protocols with the ecosystem and give them a head start, but it will leave space

for the protocols to accrue value by acquiring $VELO for long-term liquidity provision.

Grants

We have reserved 24M (6%) $veVELO to distribute to partner protocols

after the launch. This will be used to engage partners in the ecosystem through

grants.

Team

The team will receive an initial allocation that it will use to vote

to drive emissions to key protocol pairs such as $VELO-$USDC and to support

ongoing protocol development. The total team allocation is 40M (10%) in $VELO and $veVELO.

The team will vest 25% of its initial allocation in the form of a

$veVELO and use it to vote for $VELO pairs in perpetuity.

While a fully autonomous and immutable protocol is an admirable objective, it comes at a cost. Velodrome Finance will ensure its long-term sustainability by employing a dedicated team focused on supporting the product, documentation, community, and ecosystem. As the protocol evolves, the Velodrome team will consider introducing more immutability or DAO components where appropriate.

To cover ongoing expenses and all the upcoming development efforts, 3% of the emissions will be going to the team address.

The team vesting compensation breakdown:

- 15,520,816

$VELOvesting for 12 months, 6-month lock in a$veVELOfollowed by a linear 6-month unlock period. 0.5% of total emissions, taken from emissions to treasury, will be added to this bucket for dilution control. - 7,200,000

$VELOvesting for 24 months, 12-month lock in a$veVELOfollowed by a linear 12-month unlock period. - All ongoing payments made to the team members in

$VELOwill vest for 6 months, 3-month lock in a$veVELOfollowed by a linear 3-month unlock period.

Optimism Team

The Optimism team has a vested interest in ensuring that Velodrome achieves its

mission of serving as an ecosystem public good. The team will receive 20M (5%) $veVELO in the initial

distribution, to support that interest.

Genesis Liquidity Pools

Genesis Pools will distribute 4M (1%) $VELO to liquidity providers of foundational token pairs to

provide better liquidity and user experience from launch day. Genesis pool emissions will be first

directed to the $VELO-$USDC pool and will start a few days before the first epoch votes are cast.

Emissions

The initial supply of $VELO is 400M.

Weekly emissions start at 15M $VELO (3.75% of the initial supply)

and decay at 1% per week (epoch).

$veVELO holders receive a rebase proportional to epoch LP emissions

and the ratio of $veVELO to $VELO supply, thus reducing vote power

dilution for $veVELO!

The weekly rebase amount is calculated with the following formula:

(veVELO.totalSupply ÷ VELO.totalsupply)³ × 0.5 × Emissions

$veVELO supply does not affect weekly LP emissions.

Emission Schedule

Gauge Voting

$veVELO holders decide which liquidity pools receive emissions in a given epoch by

voting on their preferred liquidity pool gauges. $VELO emissions will be distributed

proportionally to the total votes a liquidity pool receives.

In return, voters receive 100% of the trading fees and bribes collected through the liquidity pool they vote for.

Voting for gauges, or in fact any action related to the $veVELO NFT is

allowed only once per epoch. This means that calling Voter.reset() (used for

resetting an NFT vote state and usually required before merging it into another

$veVELO NFT) or Voter.poke() (used to re-cast the votes for the current epoch in

order to direct emissions and earn bribes) counts as an action for the current

epoch.

While limiting the protocol participants to one action per epoch is not ideal, it does make the protocol safer against potential exploitative behaviour.

Unused $veVELO voting power is still taken into account as we calculate the

weight of the vote upon epoch flip and based on the locked vesting slope.

Please make sure you always cast 100% of your voting power to avoid unexpected outcomes!

Rewards

There are 4 types of rewards on Velodrome Finance.

Emissions

Represent $VELO distributed to liquidity pool stakers. The amount of

$VELO distributed towards every pool is proportional to the voting power

received from the voters every epoch.

These rewards are streaming and are available for claim as these accrue.

Fees

Represent liquidity pool trading fees distributed to voters in pool tokens (

e.g., if the pool is vAMM-VELO/USDC the distributed tokens are $VELO and

$USDC).

The tokens are streaming proportionally to the voting power cast by a voter and the accrued amount of trading fees.

These rewards are available for claim as they accrue. They do not need to be claimed each epoch.

Bribes

In addition to the fees, liquidity pools allow external rewards from anyone (known as bribes). Bribes can be added to whitelisted pools and are distributed only to voters on that pool, proportionally to their share of pool votes.

These rewards are available for claim after the epoch flips

(after Wednesday 23:59 UTC), and are proportional to the voting power cast by a

voter ($veVELO).

Rebases

Represent $veVELO distributed to $veVELO holders in order to reduce the

voting power dilution.

These rewards are available for claim as these accrue and are streaming

proportionally to all $veVELO holders.

Rewards claim

Rebase rewards claim is available one full epoch after tokens are locked. External bribe rewards are claimable after a new epoch has started (epochs increment right after 23:59 UTC each Wednesday).

An example of bribes, voting, and rewards claim timeline:

- A new epoch starts Thursday (00:00 UTC)

- Bribes are deposited at any point in the epoch

- Voters vote for their preferred pools

- Once the next epoch arrives (the following Thursday), users are able to claim rewards from the UI or the corresponding

WrappedExternalBribecontract

Whitelisting

While Velodrome supports permissionless liquidity pool and gauge creation, these can only include whitelisted tokens. The protocol will launch with an extensive list of pre-whitelisted tokens, including those from partner protocols.

Partners can request additional tokens to be whitelisted.

A permissionless whitelisting on-chain governance process will be implemented in the future, pending required on-chain governance infrastructure on Optimism.

Commissaire

Requirements for whitelisting are critical to ensuring that the protocol cannot be exploited by actors attempting to game emissions.

To support the health of the protocol and ecosystem, the Commissaire (a Curve-esque Emergency DAO) will have the right to disable hostile gauges.

The Commissaire will initially consist of seven members from the Velodrome team and prominent figures from within the Optimism community.